MIAC Rental AVM

utilising a database of actual rents received and rental asking price comparables, representing approx. 62% of available rental stock.

MIAC presents a cost-effective Rental AVM for residential property, perfect for Buy-to-Let Lenders and businesses with an interest in the UK rental sector.

The proprietary Rental Automated Valuation Model (R-AVM) utilises a large database of comparables to provide granular and accurate rental valuations at the property level within the UK.

The valuations provide a significant degree of detail for use in internal models and rating systems for a firm with BTL mortgage assets.

Using observed and homogenous comparables from the surrounding area, the service provides clients with anticipated rental income for each property driven by its key characteristics.

Characteristics and Methodology

MIAC presents a cost-effective Rental AVM for residential property, perfect for Buy-to-Let Lenders and businesses with an interest in the UK rental sector. The proprietary Rental Automated Valuation Model (R-AVM) utilises a large database of comparables to provide granular and accurate rental valuations at the property level within the UK.

A web-based application to support property valuation policies and governance

Postcode Entry

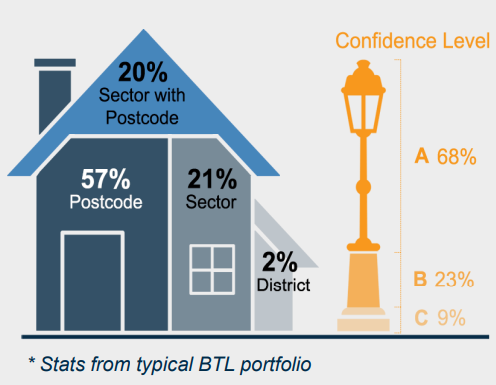

Single property Rental AVM results including confidence levels

Summary Report

Summary statistics from all surrounding geographies and property types

Utilisation

coverage ratios, underwriting / valuation ‘Quality Assurance’ and validation

Postcode, Sector and District Summary

property sales transactions in same surrounding geography

Strategy

Collections and/or Liquidation strategy influence (receivership decision making)

Policy

Lending Policy influence; ensure loans originated in most buoyant rental sub-markets